Key Points

- Rising container demand in Asian ports necessitates enhanced visibility for effective management

- Visibility tools provide real-time data, improving decision-making and optimizing operations

- Transparency helps anticipate bottlenecks and manage resources efficiently

- Leveraging visibility solutions enhances resilience and adaptability amid demand surges.

South East Asia’s ports are currently navigating significant changes and disruptions, impacting the regional supply chain. Presently, all major Asian ports are experiencing some level of congestion and delays due to disrupted shipping routes and prolonged sailing times. The ongoing issues in the Red Sea have forced vessels to take longer routes around the Cape of Good Hope, bypassing critical ports like Singapore is causing significant disruptions. This detour is creating backlogs of unloaded containers and extending transit times, straining the entire supply chain and leading to a disbalanced empty container availability across the globe.

Considering the extended transit times via the Cape of Good Hope and the uncertainties surrounding the upcoming US elections, it is crucial that containers depart as soon as possible to mitigate further delays. The congestion is exacerbated by challenges in unloading and loading cargo and compounded by difficulties in trucking, rail, barge, and feeder vessel operations. This situation not only delays shipments for shippers and carriers but also impacts retailers and consumers who depend on timely deliveries.

The situation is particularly acute at the port of Singapore, which has reached its capacity in terms of Twenty-Foot Equivalent Units (TEU). Currently, nearly 2 million containers are jammed in Singapore, causing significant congestion at the container level. This congestion is further worsened by the potential threat of new US tariffs and the uncertainties surrounding the upcoming US elections. Given the lengthy transit times via the Cape of Good Hope, these containers need to depart as soon as possible to mitigate further delays.

Moreover, the challenges extend beyond the ports. Delays in unloading and loading cargo are disrupting the operations of trucking, rail, barge, and feeder vessels, further complicating the movement of goods. This congestion is not only causing delays for shippers and carriers but is also impacting retailers and consumers who depend on timely deliveries.

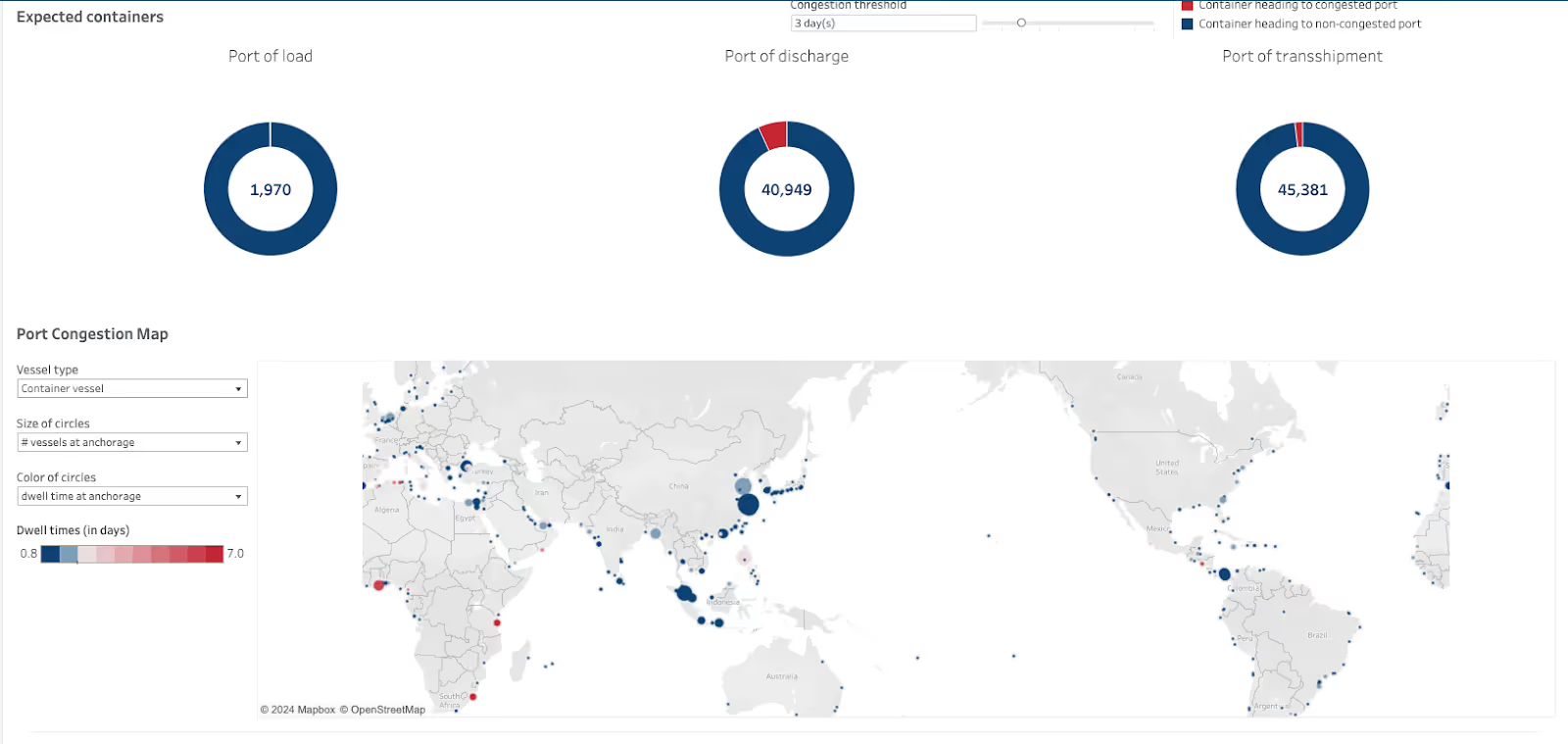

Port Visualization in Asia

Our mapping tool illustrates the current impact on major Asian ports, marked by larger circles compared to other global ports. The increased size of these circles highlights the surge in container demand and shipping disruptions at key ports like Singapore, Port Klang, and Shanghai. These critical hubs are facing ongoing challenges, underscoring the need for real-time tracking and strategic planning to manage the growing complexity in global shipping.

At Shippeo, we monitor vessels globally 24/7, tracking their movements around commercial ports, anchorages, and berths to offer a clear and up-to-date view of the current and emerging shipping landscape. While we don’t see significant port vessel congestions in our data yet, we do capture the trend and can foresee potential issues.

This technology detects and analyzes trends in shipping demand and port activity, allowing stakeholders to proactively manage increasing traffic and potential congestion. By leveraging these insights, shippers can better prepare for and navigate the anticipated rise in vessel traffic and the associated challenges. Understanding and acting on these trends enable stakeholders to navigate the evolving landscape of port congestion and container capacity challenges across South East Asia, ensuring smoother operations and fewer disruptions in the supply chain.

Recommended Actions Shippers Can Take Now

Despite the uncertain road ahead, there are several crucial strategies that can help shippers protect their supply chains, minimize delays, and meet customer demands amid market fluctuations. Here are practical steps shippers can implement in the coming weeks and months:

Utilize Predictive Analytics: Implement advanced tracking and predictive analytics tools to gain real-time insights into your shipments. These technologies can help anticipate delays and enable more efficient rerouting of shipments.

Explore Multimodal Transportation Options: Optimize your shipping routes by combining different modes of transportation (sea, air, rail, road). This approach offers more flexibility and can potentially reduce transit times.

Collaborate Closely with Logistics Partners: Maintain open lines of communication with your logistics providers. Their expertise and resources are invaluable for navigating challenges and identifying the most efficient shipping solutions.

Approach Long-term Contracts with Caution: Given the fluctuating freight rates and unpredictable transit times, be cautious with long-term shipping contracts. Seek contracts that include flexibility or contingency clauses to adapt to changing conditions.

Educate Customers and Manage Expectations: Be transparent with your customers about potential delays and disruptions. Clear communication can help manage expectations, maintaining trust and loyalty during challenging periods.

* Shippeo customers can expect to receive a walkthrough demo that identifies the impacted containers during a port saturation context.

Near-term and Long-term Insights on Disruption

Stakeholders are divided on how long the surge in demand will continue to fill all available capacity on the Asia-Europe ocean trade. While some believe this unexpected spike will subside by the end of the current peak season, others forecast it could extend until the Lunar New Year in late January.

Amidst these varying projections, Chris Mazza, Shippeo's resident ocean expert and SVP of International Growth, offers crucial insights into both the near-term and long-term disruptions affecting the supply chain:

Near-Term Disruptions

Bulking Up Inventory: Importers are stockpiling inventory to save money in response to looming trade restrictions. This action consumes more vessel and container capacity, driving up ocean carrier freight rates on impacted trade lanes.

Warehouse Capacity Strain: Despite extensive warehouse construction in the USA, available space is expected to be strained, increasing storage and labor costs.

Long-Term Disruptions

Shifting Manufacturing Bases: Chinese manufacturers are expanding operations in Mexico to mitigate the impacts of trade tensions. This shift will alter how American importers operate, as they increasingly source from Mexico instead of China.

Diversifying Supply Chains: American importers are restructuring their supply chains to reduce dependence on China, with notable examples including Apple moving production to India. This trend is expected to continue, affecting ocean carrier service structures and potentially the North American over-the-road truckload market.

New European Trade Rules: Emerging European trade regulations will also shape global supply chain dynamics in the coming years.

To tackle these challenges, join us for the webinar "Ocean Freight: Turning Uncertainty into a Competitive Advantage with Visibility." Industry experts Lars Jensen, CEO of Vespucci Maritime, and Chris Mazza, SVP of International Growth with Shippeo, will guide you through the current storm. Register Now

The Growing Importance of CO2 Emission Calculation

In addition to navigating supply chain disruptions, it is increasingly important to consider the environmental impact of door-to-door intercontinental movements. Shippeo offers a comprehensive solution for calculating CO2 emissions, providing shippers with crucial insights into the carbon footprint of their logistics operations.

.avif)

Why Ocean Carbon Visibility Matters:

Anticipate Carbon Taxation: With carbon taxation on the horizon, tracking the CO2 emissions of your shipments will become essential for cost management and compliance.

End-to-End Visibility: Shippeo ensures complete transparency from origin to destination, allowing shippers to monitor and optimize their carbon footprint throughout the entire supply chain.

By leveraging Shippeo’s Ocean Carbon Visibility, businesses can not only improve their environmental sustainability but also prepare for future regulatory requirements. Contact Shippeo today to learn more about how our solutions can help you track and reduce your goods’ CO2 emissions.

Latest blogs & product releases.

Authors