In our previous blog on September 19th, we focused on the risk of a strike and key considerations for evaluating and mitigating disruption risks. Now, a significant dockworker strike has begun at seaports along the U.S. East and Gulf coasts, poised to disrupt global supply chains and the economy. If this work stoppage continues for an extended period, American consumers could face shortages of many popular products.

Workers at ports from Maine to Texas initiated the strike early Tuesday, driven by disputes over wages and the use of automation. This unprecedented action by the International Longshoremen’s Association (ILA) union, the first in nearly 50 years, is expected to have serious repercussions for ships transporting billions of dollars' worth of cargo. The ILA, representing around 45,000 port workers, made good on its threat to strike at 14 major ports after negotiations with the United States Maritime Alliance (USMX) broke down just before the September 30 deadline.

Use Shippeo to manage the transportation risks in your Global Supply Chain

To effectively navigate these disruptions, before the execution; it’s crucial to have insightful data about lead time variability, port congestion status, and demurrage and detention (D&D) picture in order to plan your next shipments and customer commitments. At the execution phase; with Shippeo, you can easily visualize your impacted shipments and stay informed about last minute events.

.avif)

If you have questions about how Shippeo can help during these challenges, don’t hesitate to book a demo with our team.

Current Congestion Trends

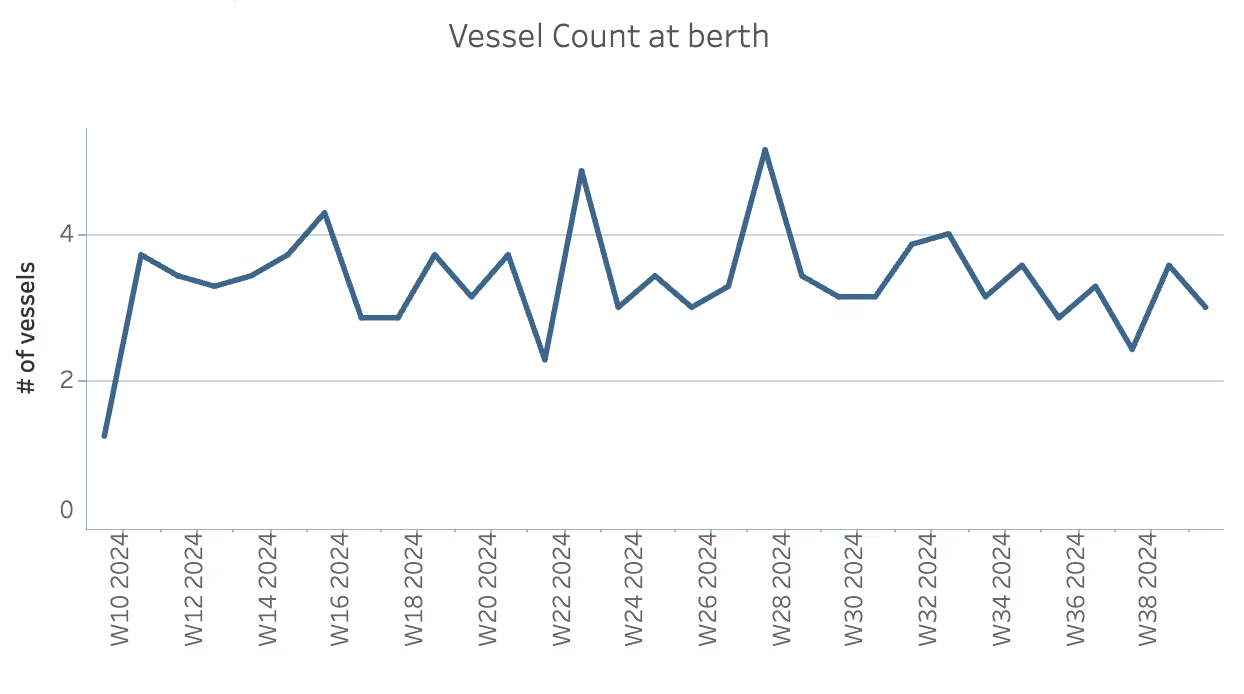

CAMTR (Montreal)

- Berth Dwell Time: +45% increase compared to the previous two weeks’ average.

- Median Vessel Dwell Time: 3.7 days (up from 2.5 days in CW37).

- 25% of vessels have a dwell time below 2.4 days.

- 75% of vessels have a dwell time below 5.5 days.

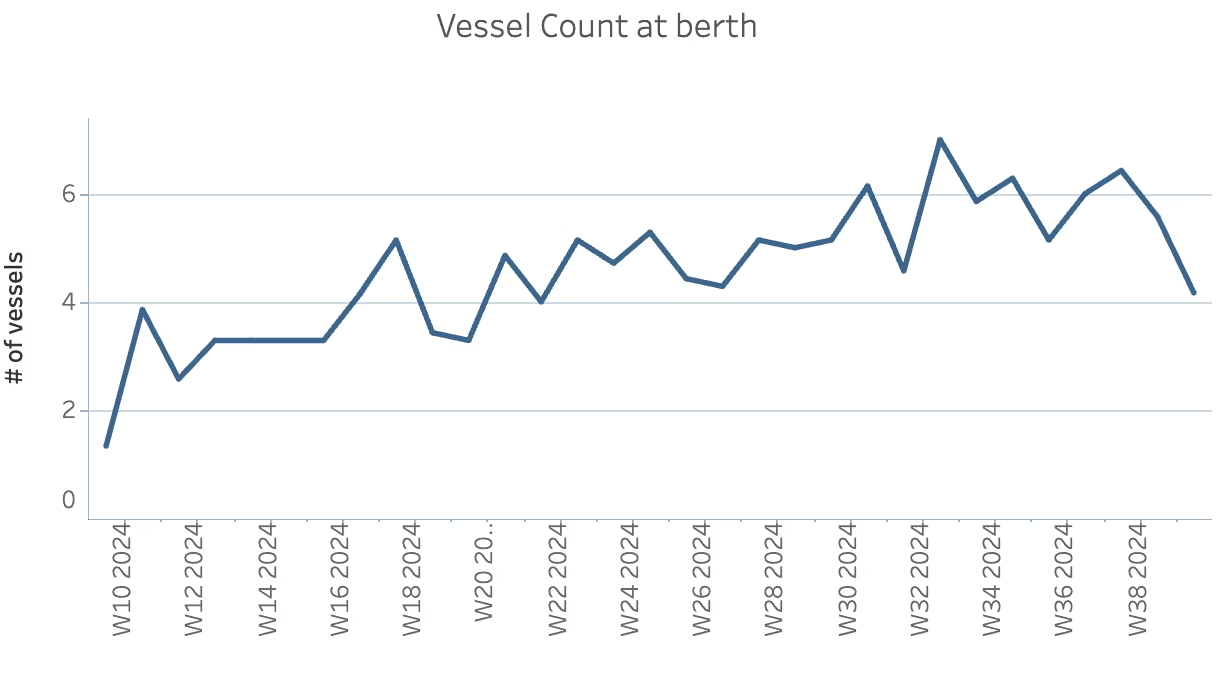

MXLZC (Lázaro Cárdenas, Mexico)

- Median Vessel Dwell Time: 2.8 days.

- 25% of vessels have a dwell time below 2.1 days.

- 75% of vessels have a dwell time below 4.3 days

Alternative Solutions and Strategies

As port congestion increases, exploring alternative solutions with a broader geographic scope becomes essential. Here are some strategies to consider:

1. West Coast Ports (U.S.)

Key Ports: Los Angeles, Long Beach, Oakland, Seattle

West Coast ports remain viable options, especially for goods from Asia. Despite potential congestion, they offer robust capacity and intermodal infrastructure.

- Challenges: Increased demand may lead to delays and higher costs, with a slight risk of strikes in solidarity with East Coast and Gulf Coast ports. However, access to major rail lines and highways across the U.S. remains a significant advantage.

2. Canadian Ports

Key Ports: Vancouver (West Coast), Halifax (East Coast), Montreal (via St. Lawrence River)

Canada’s ports provide strong connections to the U.S. via rail and road. Vancouver is particularly advantageous for Pacific trade routes, while Halifax and Montreal can handle trans-Atlantic shipments.

- Challenges: Overland transportation costs and times from Canadian ports to central or southern U.S. locations may be higher. Be mindful of empty return detentions and the approaching winter season in your planning.

3. Mexican Ports

Key Ports: Manzanillo, Lázaro Cárdenas (Pacific Coast), Veracruz (Atlantic Coast)

Mexico's Pacific ports offer strong alternatives for West Coast trade, with effective rail and truck routes into the U.S. Veracruz on the Gulf can substitute for U.S. Gulf Coast ports, especially for trans-Atlantic cargo.

- Challenges: Infrastructure may not match U.S. standards, and customs processes could add time. However, major Mexican ports are improving their capacity for international trade.

4. Panama Canal and Latin American Ports

Key Ports: Colon (Panama), Cartagena (Colombia), Santos (Brazil)

For longer-haul routes or significant congestion in North America, shippers can use Latin American ports as waypoints. From Panama or Cartagena, goods could be rerouted via Central America or shipped onward to less congested North American ports.

- Challenges: Expect extended shipping times and potential cost increases, but this approach can provide greater flexibility.

Summary of Potential Impacts

- Cost Increases: Transportation and logistics costs are likely to rise as demand pressures grow on alternative routes.

- Congestion: Increased reliance on West Coast ports or Canadian/Mexican options may lead to congestion, delays, and capacity constraints.

- Diversification of Routes: The current situation may prompt businesses to diversify their supply chain routes, reducing reliance on any single geographic area for entry points.

Latest blogs & product releases.

Authors